As 2024 approaches, the future profitability of crypto mining has received increased attention. This article will look at the upcoming Bitcoin halving in 2024, market volatility, technical challenges, and miners’ strategies to deal with them. Learn how to remain competitive and profitable in the ever-changing crypto market.

Table of Contents

- What is Bitcoin mining?

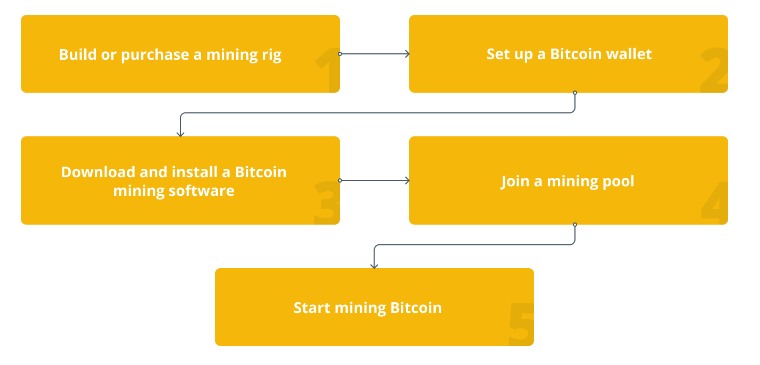

- How Do I Get Started Mining Bitcoin?

- Components of Bitcoin Mining

- Bitcoin Mining Difficulty Rate

- Individual Profitability

- Technical Challenges and Operational Costs

- Bitcoin Mining in a Bear Market

- Conclusion

What is Bitcoin mining?

Bitcoin mining is the process of verifying and recording Bitcoin on a blockchain.

Bitcoin miners use powerful computers to complete complex mathematical functions known as hashes. The processing power required to mine Bitcoin is extremely high, but Bitcoin miners are rewarded with 6.25 BTC, or roughly $143,000, for mining each block of transactions on the blockchain.

These mining operations are frequently constructed near affordable energy sources such as hydroelectric dams, oil and gas wells, and solar energy farms.

How Do I Get Started Mining Bitcoin?

While self-mining may provide slightly higher margins, it is a risky endeavor. Not only does it necessitate extensive technical knowledge, but the process of obtaining machines, electricity, and a facility involves a number of obstacles.

However, since self-mining is impractical for many people, a solution in the form of hosted mining has emerged. In hosted mining, a third-party custodian purchases the machines, electricity, and facilities in exchange for a monthly hosting fee.

River proudly offers a hosted mining product to customers in the United States. You can buy miners directly through our app and track your progress as bitcoin is mined directly into your account.

Components of Bitcoin Mining

Several factors influence whether Bitcoin mining is profitable, including the cost of electricity used to power the mining machines, machine availability and price, and mining difficulty.

Hashrate

Hashes are 64-digit hexadecimal numbers generated by a mining program that attempts to solve for the most recent hash.

Hashrate is a cryptocurrency industry metric that indicates how many hashes a mining entity can generate per second while mining.

As the network is designed to produce a certain number of bitcoins every 10 minutes, the difficulty of hashing varies with the number of miners entering and leaving.

When more miners enter the market, the difficulty increases in maintaining the same number of bitcoins produced.

Because each hash generated is random and impossible to predict, it may take millions of guesses, or hashes, before the target is met and a miner is granted the right to fill the next block and add it to the blockchain.

Each time this happens, the successful miner(s) receives a block reward of newly minted coins, as well as any transaction fees.

ASIC

Prior to the development of bitcoin mining software, early miners made money using personal computers. Miners owned their systems, so equipment costs were minimal. They could adjust the settings on their computers to run efficiently.

Furthermore, professional bitcoin mining centers with massive computing power had yet to emerge. Miners competed solely against other individual miners on home computer systems.

The first set of application-specific integrated circuits (ASICs) for bitcoin mining was released in 2013 by Canaan Creative, a Chinese computer hardware manufacturer.

Individuals began competing against powerful mining rigs with higher computing power. Mining profits have been slashed due to rising computing equipment expenses, higher energy costs, and increased mining difficulty.

Bitcoin Mining Difficulty Rate

To ensure that bitcoin blocks are discovered every 10 minutes, an automatic system is in place that adjusts the difficulty based on the number of miners competing to discover blocks at any given time.

The difficulty rate measures how difficult it is to mine a bitcoin block or find a hash less than a specified target. The higher the difficulty rate, the less likely it is for a single miner to successfully solve the hash problem and earn bitcoins.

In recent years, the mining difficulty rate has risen significantly. When Bitcoin was first introduced, the difficulty was one hash. On November 8, 2023, it was 62.46 T (T represents trillion hashes). The number of hashes required to mine one block), confirms the increased difficulty associated with mining since its inception.

Individual Profitability

Bitcoin mining continues to be profitable for some individuals. Equipment is easier to obtain, though competitive ASICs can cost anywhere from a few hundred dollars to tens of thousands of dollars.

Some machines have been modified to maintain their competitiveness. For example, some hardware allows users to adjust settings to reduce energy consumption, lowering overall costs.

Prospective miners should conduct a cost-benefit analysis to determine their break-even point before investing in fixed-cost equipment. The cost of power, efficiency, time, and the value of bitcoin are all factors to consider.

A profitability calculator, such as the one provided by CryptoCompare, assists potential miners in determining the cost-benefit equation of Bitcoin mining. Profitability calculators differ slightly, with some more complex than others.

Technical Challenges and Operational Costs

As incentives dwindle, efficient mining equipment and low-cost energy solutions become essential. To keep up with the competition, miners must invest in advanced mining hardware and seek cost-effective energy solutions.

This year, Bitmain, , and Canaan-Creative launched efficient ASIC miners. It is expected that more efficient and energy-saving mining equipment will be introduced in the future.

Bitcoin Mining in a Bear Market

In a bear market, a miner’s primary goal is to survive. The last thing a miner wants to do is turn off their machines, missing out on potential mined bitcoin and pushing back the timetable for recouping their initial investment.

To ensure that machines continue to hash, an operation must first understand its operating threshold. This must also be kept in mind during bull markets. But it is in bear markets that operating thresholds are tested.

A miner’s operating threshold is the lowest bitcoin price and maximum network hash rate at which they are willing to mine. Operating thresholds differ by miner, as each miner establishes their own threshold based on their specific goals.

Mining is not all bad during a bear market, as low rig prices present a potential opportunity for miners looking to expand their operations. As miners turn off their machines, the network hash rate falls, and the difficulty usually decreases. Mining becomes easier for the miners who continue to operate.

Conclusion

The profitability forecast for cryptocurrency mining in 2024 is fraught with challenges and opportunities. Miners and investors must take into account market volatility, technological advancements, energy costs, and the regulatory environment. Despite the uncertainty, correct and flexible strategy adjustments and technological upgrades can help miners remain profitable in the mining market. As a result, miners and investors must remain vigilant and constantly adapt to this rapidly changing industry. In this volatile market, acumen and adaptability will be essential.