Founded in the United States in 2017, Live Coin Watch in 2024 offers up-to-date data and analysis on over 27,000 currencies sourced from more than 600 exchanges.

Market Trends Analysis

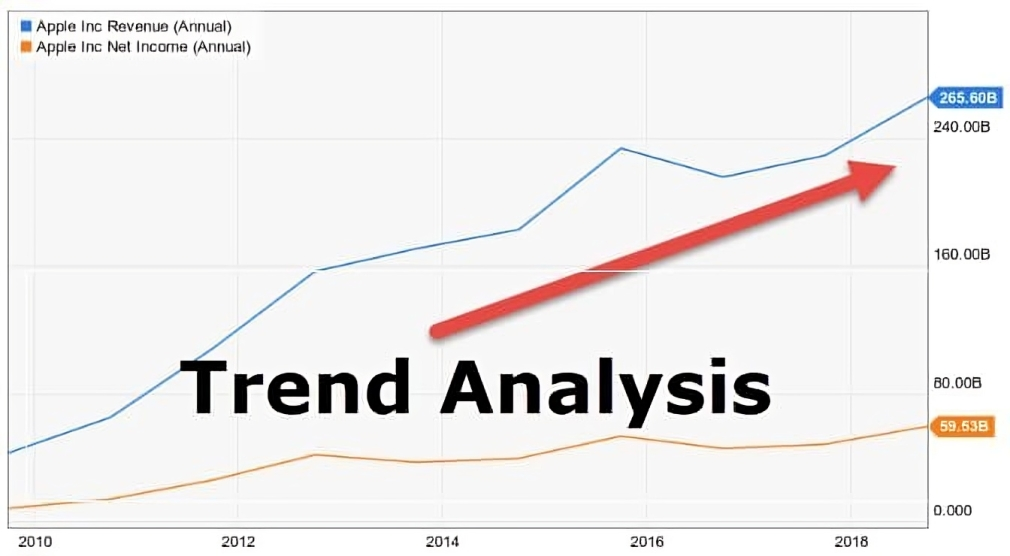

Any firm must remain abreast of market changes to maintain its competitive edge and guarantee steady growth. The goal of market trends analysis is to find gaps, patterns, and opportunities by investigating and tracking changes in the market.

Every organization may benefit greatly by mapping out market trends. This enables you to:

- Seek out fresh chances. It is possible to identify opportunities for development and expansion by monitoring new trends and changes in customer behavior.

- Maintain your edge. You may adjust your tactics to better suit evolving customer demands and outmaneuver rivals by keeping a careful eye on market developments.

- Make better business choices. You may create profitable goods and services, develop potent marketing plans, and overall improve your firm by having a solid understanding of market trends.

1: Define Your Destination

You may use this to choose the kind of analysis to perform and the data to examine. Consider aiming for a new market niche or testing a novel product idea.

2: Staying Ahead Of The Game

Remember to take into account other influences as well, such as cultural shifts, economic situations, and governmental regulations.

3: Unleashing The Power Of Research Tools

Make use of consumer insights platforms like CryptoMagnetx and market research tools like Google Trends, Statista, and BuzzSumo.

4: Customer Intelligence

To gain a deeper understanding of your current clientele, gather and examine consumer feedback, do surveys, and examine social media data. You may expedite this procedure by using tools such as cryptomagnetx.

5: The Magic Of Analytics

By using your current data sets, you may use predictive analytics tools to predict future trends and spot opportunities. You may work around your study data in a sophisticated yet very effective way with this method.

6: Mapping Your Path To Success

Consider this:

- Does this trend apply to my sector and business?

- Is my current marketing and business plan adequate, or do I need to make changes?

- Do my rivals consider this tendency when making decisions?

- Does this pattern align with our understanding of our clientele?

- Does my business face any possible threats or opportunities?

Remember, you can react and take advantage of chances more skillfully if you can identify big patterns earlier.

Major Cryptocurrencies

This page defines and contrasts Litecoin, Ether, and Bitcoin, the three most popular cryptocurrencies traded globally. Continue reading to see the most recent news on the cryptocurrency market, as well as live price updates and information on the many variables that affect prices, such as regulatory actions and speculative activity.

- Describe cryptocurrencies.

- top cryptocurrencies exchanged globally

- What influences the price of cryptocurrencies?

- Trading hints

Describe Cryptocurrencies.

Almost two thousand cryptocurrencies exist now as a result of the meteoric rise in popularity that they experienced since their inception in 2009. Cryptocurrencies that are considered “major” include Litecoin, Ethereum, and Bitcoin. The cryptocurrencies with the biggest market capitalization are those that are traded the most globally.

Majors are digital assets that use sophisticated mathematics and computer science, or cryptography, to safeguard and verify transactions, much like all other cryptocurrencies. Currently, they are neither backed nor issued by a central authority like a government, in contrast to traditional (or “fiat”) currencies.

Bitcoin (BTC)

However, because of Bitcoin’s sharp price fluctuations, some businesses avoid using it as cash, while others do accept it. In January 2017, the price of one Bitcoin was $1,151, and by December of that same year, it had risen dramatically to an all-time high of $19,783, mostly from speculation.

In February 2018, it then fell below $7,000 before quickly rising to almost $11,000 before falling below $4,000 once more. As a result, traders should be aware of one of the main aspects of Bitcoin: its significant volatility potential.

Ether (ETH)

Ether (ETH) is a cryptocurrency that powers the Ethereum blockchain network. Ethereum is a use of blockchain technology that is more widely used than Bitcoin, which was intended to be digital money.

Litecoin (LTC)

In October 2011, Charlie Lee, a former employee at Google, launched Litecoin. Litecoin, which debuted as a less expensive variant of Bitcoin for daily use, originated from a “hard fork” (split) of the Bitcoin Core client, the open-source, free software that powers the cryptocurrency. Compared to Bitcoin, Litecoin has quicker transaction speeds and a larger supply—84 million Litecoin instead of 21 million—because it has a larger potential.

Summary Table: Bitcoin, Ether, and Litecoin

| BITCOIN (BTC) | ETHER (ETH) | LITECOIN (LTC) | |

| Launched in | 2009 | 2015 | 2012 |

| Market cap | $78.3 bn | $13.6 bn | $2 bn |

| All-time high price per unit | $19,763 | $1,432 | $375 |

| Transaction speed | Slow | Fast | Slow |

| Corporate users | No | JPMorgan Chase, Microsoft, CME Group, and BNY Mellon | No |

What Influences The Price Of Cryptocurrencies?

News Announcements

The sensitivity of cryptocurrencies to news releases might be quite great. News about networks being compromised or the CEO of JPMorgan Chase labeling Bitcoin a “fraud” are examples of the kinds of stories that might have an impact on pricing. Furthermore, traders may get disenchanted with these more conventional trades and switch to cryptocurrency transactions, which would raise the price as a result of political and economic developments impacting fiat currencies.

New Cryptocurrencies

As of November 2018, there were over 2,000 cryptocurrencies accessible for trading. The standing of current coins may be in jeopardy when new and more cryptocurrencies, supported by quicker and more effective networks, hit the market. For instance, as of October 2018, TRON (TRX) has a higher network transaction value than other well-known cryptocurrencies with a higher market capitalization, including Bitcoin and Ether. Furthermore, some sites identify over 900 cryptocurrencies that have been declared “deceased,” highlighting the fierce rivalry that each currency has endured.

Essential Hints For Cryptocurrency Trading

Whether you want to trade cryptocurrencies for the short term or long term, there are a lot of things to think about. Are you open to volatility and do you have a high risk tolerance? Are you looking to expand your cryptocurrency holdings or eventually transition into a different asset class? Which trading method would you rather use—position trading for a longer-term perspective or day trading?

Key pointers are as follows:

Choose The Trading Style That’s Right For You

The first thing you need to decide before choosing the coins themselves is how you want to exchange cryptocurrencies. You must choose between using an exchange and trading using derivatives.

- Trading via Derivatives: You may speculate on the price of cryptocurrencies without having to hold the underlying coins when you trade them using financial derivatives like spread betting, binary options, or CFDs (where permitted).

- Trading via an Exchange: When trading through an exchange, you must buy the assets outright and hold your tokens in a digital wallet until you’re ready to sell. You may have to pay hefty trade costs.

Manage Risks Through Stop Loss And Limit Orders

When trading cryptocurrencies, risk management is extremely important, especially because the markets may be very volatile. Establishing stop losses and limit orders is crucial. You should also decide how much loss you can tolerate and make sure these decisions are reflected in your trading strategy.

Conclusion

LCW is unquestionably worthwhile to try. Since I find the social tab in CMC to be helpful, I would continue to utilize it. Aside from that, the automatic price update, watchlist, and layout are the key reasons I’ll continue using LCW. Kindly let me know your comments on this as well as if you know of a superior option in this area.