OKex Crypto in 2024 is a controversial cryptocurrency and digital asset exchange that came into existence in 2014 by Star XU in Belize. The business, which conducts its main operations in Hong Kong, has some major support. After the Chinese government outlawed the trading of initial coin offerings (ICOs), the exchange—along with its sister company OKCoin moved to Hong Kong and now has a worldwide focus. . Draper has made several profitable early-stage investments in businesses like Baidu, Tesla, and Hotmail.

Table of contents.

1. Introduction:

Briefly introduce OKEx, its history, and its current standing in the cryptocurrency exchange market.

2. Regulatory Landscape for OKEx in 2024

* Discuss the current regulatory climate surrounding OKEx, particularly any major changes or updates that happened in 2024. * Analyze how these regulations might impact OKEx’s operations and user base.

Exchange Platform

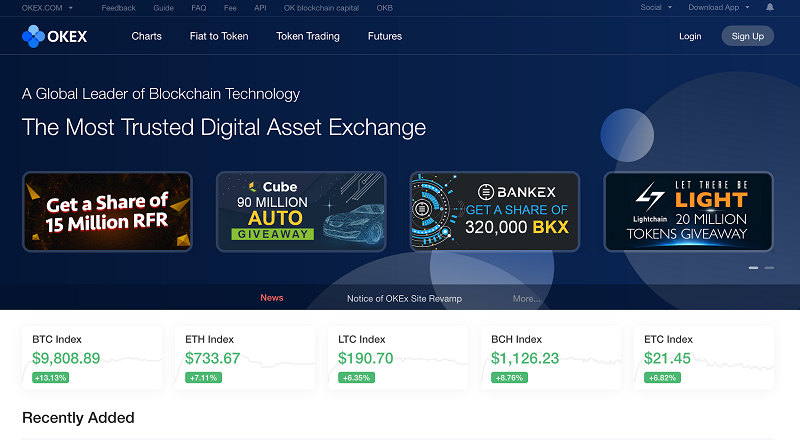

The Okex exchange platform may be accessed using a web browser or with a desktop client application that requires download. Trading platforms are rather resource-intensive, so downloading software that does the majority of the work helps you prevent the possibility that your browser could freeze or have memory and processing issues. Compared to other cryptocurrency exchanges, OKex demands more hardware due to its more sophisticated exchange platform.

The exchange platform itself is well made and has a style that is reminiscent of upscale, conventional financial markets trading systems.

Market Position:pen_spark

Explore how OKEx is positioned in the cryptocurrency exchange landscape in 2024. Is it still a major player? How does it compare to competitors like Binance or Coinbase?

Exchange Markets

The Okex exchange provides both a fiat for cryptocurrency trading and the typical crypto-to-crypto trading seen on most cryptocurrency exchanges. Regretfully, at this time, the only supported fiat currency is the Chinese Yuan. With new alternatives added regularly, the exchange offers well over a hundred coins and tokens.

The site offers margin trading as well, with maximum leverage of 20:1, the largest of any cryptocurrency traded or CFDs broker. In cryptocurrency markets, margin trading is often restricted to a ratio of 20:1, owing to their high price volatility.

Along with futures trading, OKex also provides weekly, bi-weekly, and monthly contracts for Bitcoin, Ethereum, and EOS. Futures contracts can also come out for consumption using leveraged margins.

Algorithmic trading capabilities have come to the top of the exchange’s list of extra functionality.

Fees

Okex can slip through the cracks to have some of the lowest trading costs in the cryptocurrency industry, which is one of its main advantages. Despite being modest even at the top of the scale, fees are tier-based on average 30-day trading volumes. A 0.2% taker charge and a 0.15% maker fee are the highest trading costs that apply to low-volume accounts. As for makers’ and takers’ fees, respectively, this drops to 0.02% and 0.05%.

Security And Fairness

It is reasonable to believe that Okex’s cybersecurity architecture complies with industry best practices given its status as one of the largest cryptocurrency exchanges in the world and its financial backing. GSLB, distributed server clusters, and multi-signature cold storage wallets are itemized on the exchange itself as security precautions.

Several Okex account customers reported in October 2017 that their Bitcoin holdings had gotten mugged and their accounts had been adversely affected. The exchange attributed this to the account holder’s inability to keep their account safe and their disclosure of login credentials. Claims that the exchange’s security measures were insufficient did not meet the criteria, and customers, if only, had revised security instructions for their wallets and accounts.

Support

In addition to phone lines, email-based ticketing systems, many messaging applications, and social media platforms, OKex provides customer assistance. Mixed reviews of assistance levels can take place online, along with some grievances about poor problem-solving or sluggish response times. Although the exchange’s procedures and methods seem quite rigid in general, users who recognize this and adjust accordingly report minimal issues.

Pros And Cons

Pros

- extensive range of pro-trade options, such as futures

- Fiat for cryptocurrency support

- High-level trading platform

- Leverage trading

- An extensive range of over 100 cryptocurrencies supported

- Low Fees

Cons

- CNY only fiat supported for now

- Mixed reviews on customer service

- China’s market focus, though, should change with international expansion ambitions

Conclusion

Okex is a reputable exchange with big plans for the world. Few cryptocurrency exchanges, even for more seasoned traders, provide the type of expert trading platform that OKex provides, complete with features and trading formats typical of large, established financial exchanges in traditional markets. Another significant benefit that will especially appeal to more seasoned traders is low trading fees.

Although that is likely to change shortly, Okex is currently heavily focused on the Chinese market, given that CNY is the sole fiat currency accepted on the site.